Complete end-of-year accounting tasks in your property management software to ensure a smooth start to the new year and an easy tax season. This end-of-year checklist from Rentec Direct covers items you should review in your account.

The end of the year is the best time to go through your software to review items and organize your data so you are prepared for year-end reporting and submitting your taxes. The data stored in your Rentec Direct is vital for maintaining accurate tax records and business records.

This end-of-year checklist from Rentec Direct covers items you should review in your account. There are a lot of items on this list, and if you have been doing monthly reporting, you will be in good shape for all your end-of-year tasks.

While going through this checklist, if you stumble upon any data that doesn’t match up and you need help along the way, please reach out to your Rentec Direct team at success@rentecdirect.com; we’re always here to help you.

This property management end-of-year checklist will cover:

- General housekeeping tasks and reports to review

- Accounting tasks

- Forecasting tasks

A big part of end-of-year prep is ensuring that your financial records are accurate and up to date, so there is a big focus on the accounting tasks in this checklist. Beyond accounting, you also need to consider general housekeeping and forecasting items to complete in your software.

End-of-Year General Housekeeping Tasks in Rentec Direct:

The Summary Page in your Rentec Direct is your dashboard, and provides at a glance items that may need your attention.

Helpful tip: When you’re on the Summary Page, make sure “All Properties” is indicated in the upper right-hand corner.

Pending Tasks in your Rentec Direct account:

- Click on the notification bell icon in the upper right to review pending tasks

- Complete any open work orders

- Finish pending move-outs

- Review tenants, vendors, and owners for accuracy (including updating addresses/contact information)

- Verify Tax ID numbers for your company, owners, and vendors

- Review property insurance

Reports to Review in Rentec Direct:

- Review Lease Expiration report

- Review Delinquent Tenant report for issues that may need to be addressed

- Review Renters Insurance report

End-of-Year Accounting Tasks in Rentec Direct:

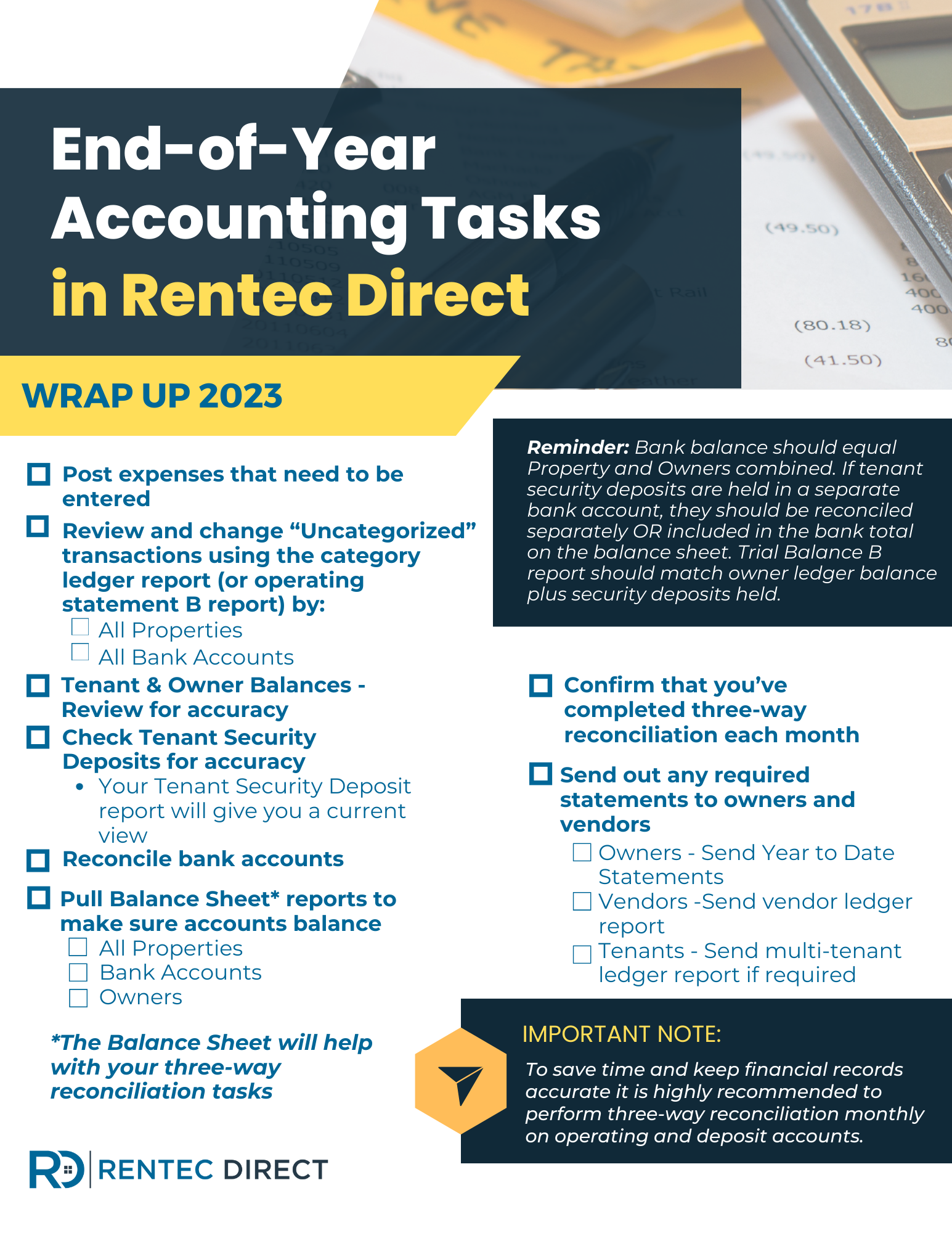

- Post expenses that need to be entered

- Review and change “Uncategorized” transactions using the category ledger report (or operating statement B report) by:

- All Properties

- All Bank Accounts

- Tenant & Owner Balances – Review for accuracy

- Check Tenant Security Deposits for accuracy

- Your Tenant Security Deposit report will give you a current view

- Reconcile bank accounts

- Pull Balance Sheet* reports to make sure accounts balance

- All Properties

- Bank Accounts

- Owners (if applicable)

*The Balance Sheet will help with your three-way reconciliation tasks

Notes: Bank balance should equal Property and Owners combined. If tenant security deposits are held in a separate bank account, they should be reconciled separately OR included in the bank total on the balance sheet. Trial Balance B report should match owner ledger balance plus security deposits held.

- Confirm that you’ve completed three-way reconciliation for all 12 months of the year

Note: To save time and keep financial records accurate it is highly recommended to perform three-way reconciliation monthly on operating and deposit accounts. - Send out any required statements to owners and vendors

- Owners – Send owners Year to Date Statements

- Vendors -Send the vendor ledger report to vendors as needed

- Tenants – If you are required to provide tenants with ledger reports, send the multi-tenant ledger report per property

End-of-Year Forecasting Tasks:

This is a great time to review any required or internal updates to policies, procedures or requirements.

- Policy updates – Review changes that may need to be implemented

- Tenant rental agreements

- Management agreements

- Internal policies and procedures

- Review any upcoming trends or changes in rates or fees

- Review any upcoming large expenses such as remodels or improvements

- Marketing Plan – Make a plan to meet your business goals

Rentec Direct Help Articles to Support End-of-Year Property Management Tasks:

- 3-Way Reconciliation Worksheet

- Audit Assistance Tools

- Bank Account Reconciliation

- Bank Sync

- Transaction History Audit Log

Final Thoughts

Completing the end-of-year tasks in your property management software is crucial for a seamless transition into the new year and a stress-free tax season. The comprehensive checklist provided by Rentec Direct covers general housekeeping, accounting, and forecasting tasks to ensure your financial records are accurate and up-to-date.

By diligently reviewing your records, addressing pending tasks, and verifying crucial information, you set the foundation for a well-organized property management system. The emphasis on accounting tasks, including expense posting, transaction categorization, and three-way reconciliation, ensures the accuracy of your financial data.

The end-of-year forecasting tasks prompt you to review and update policies, agreements, and anticipate upcoming trends or expenses, contributing to the strategic planning of your property management business.

Remember, if you encounter any challenges during this process, the Rentec Direct team is readily available to provide assistance. As you complete these tasks, you not only prepare for the upcoming year but also establish a solid foundation for the continued success of your property management endeavors. Here’s to a successful year-end and a prosperous start to the new year!