Perhaps one of the valuable tools for successful rental management is utilizing a full proof tenant screening process to find the best renter for your property.

Tenant screening involves evaluating rental applicant’s personal information provided on a rental application and their credit, criminal, and eviction history in order to determine if they are a responsible renter.

This tenant screening guide will show you how to successfully screen a tenant quickly and accurately in order to make an informed decision on which prospective rental applicants to approve and which to decline.

What makes a great renter?

There are two important traits an experienced landlord looks for in a prospective tenant: the ability to pay rent on time and the ability to care for the property.

A tenant who does not possess either of these traits can cost a landlord thousands of dollars in damage and lost rent.

Follow the steps below for the best chances of finding a tenant who complies with both of these important good renter traits.

Credit Report for Tenant Screening

Credit reports are available to both professional property managers as well as private landlords. The credit report gives insight into how well the tenant meets their financial obligations and pays their bills.

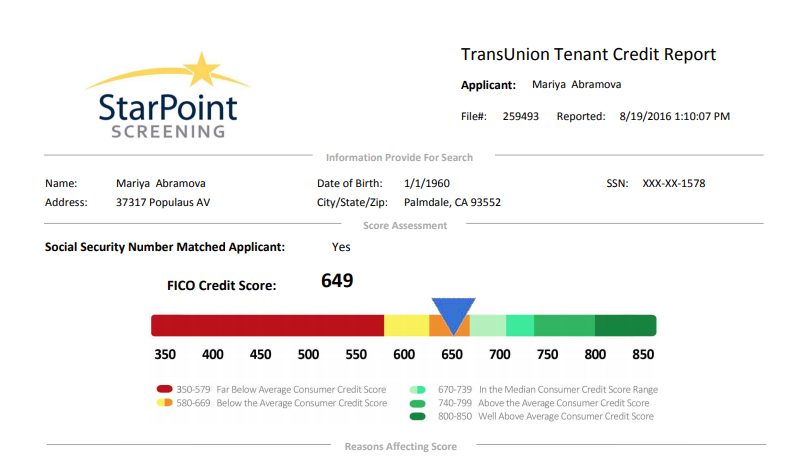

There are two types of credit reports available to landlords and property managers: a full credit report or a credit report card. The main difference between a full credit report and a credit report card is that a full credit report gives you a FICO score. The credit report card will give you a score range.

A full credit report will give you the FICO score of the rental applicant along with detailed credit history.

Full Credit Report vs. a Credit Report Card for Tenant Screening:

What to look for in a credit report when screening a tenant

- Credit Scores. Different credit reporting agencies report scores differently, so basing a decision on a score is not always going to provide the same results across all major credit agencies. When a FICO score is returned, scores can range from 300 – 850 with 850 being impeccable credit. If the tenant recently lost their home to short sale or foreclosure, their score might be even lower almost entirely based upon the loss of their home and should be factored in accordingly.

- Debts. When a score is included and is near or above 650, generally you can count on the tenant as a good payer. It’s still a good idea to review the content of the report to make sure there are no current obligations past due. The most important gauge as to if a tenant will pay their rent is if they are paying their current obligations such as credit cards. If current obligations are past due, this is a great indication that the tenant is financially strapped and may not be able to afford rent either.

- Late mortgage payments. Most property managers provide a special exception when a prospective tenant’s credit history shows late mortgage payments or mortgage default. Because these previous homeowners tend to be very positive and responsible renters and provided other obligations are current, most landlords I have interviewed do not reject prospective tenants based on poor credit from the loss of a home.

- Medical bills. Another component of a poor credit score can be related to medical bills. An uninsured person with even a short hospital stay can attain tens to hundreds of thousands of dollars in medical bills in short order. It’s fairly impractical for most people to pay these bills at the time of the visit and as such, they can often be turned into a collection. In interviewing numerous landlords, medical bills are often disregarded or lesser regarded when considering a prospective tenant’s creditworthiness. It is, however, important to take into consideration the tenant will have a portion of their income going to these bills, likely from garnishment. This reduces their income to afford rent and could impact your income to rent formula.

Criminal Background Report for Tenant Screening

There are a number of criminal reports available to landlords and property managers. One of the most popular and easy to obtain is a nationwide criminal history.

A nationwide criminal history report aggregates criminal data from states nationwide to provide a concise view of the criminal behavior of an applicant. Unlike credit data, criminal data is not indexed by social security number. Instead, criminal data is typically indexed by name and date of birth.

Even still, some jurisdictions only record criminal data by name only which makes determining criminal behavior a little more tricky than with credit.

Here are some tips to get the most from your criminal background reports.

- Be certain the name and date of birth (DOB) are correct when ordering your criminal report. An applicant could accidentally or purposefully mistype their DOB on your application form which could cause a criminal report to appear clean, when it may not be. The best way to guarantee this information is obtained correctly is to request a copy of a photo id with the application so you can verify the date of birth.

- Verify address history. Each criminal record returned will typically list the county or city of the offense. Many screening vendors will cross-match these entries with an address history report for the applicant, to narrow the results to a manageable list; however, if your vendor provides you a complete list, it can be quite long.

To verify if a criminal record matches your applicant you can order an address history or SSN verification report that includes address history. If a past address matches a city where the criminal offense took place, it’s a good bet the offense matches the applicant.

- When in doubt, order a more detailed report. If the national or state-wide report you’ve run is inconclusive, you can order a county report on the applicant, which may include more details.

- Review your federal, state, and local laws on the legal use of criminal backgrounds. According to the Fair Housing Act, in general, a housing provider may only consider arrest records that lead to a conviction and may not place a blanket ban on all criminal history. Additionally, some jurisdictions have made it illegal to use the information found on a criminal background report for tenant screening.

Eviction History Report for Tenant Screening

Perhaps the single most important factor when renting to a new tenant is if they have previously been forcefully evicted. An eviction report will give you insight on a rental applicant’s history of evictions.

There are three primary ways a tenant moves out of their rental:

1) They paid their rent on time and chose to move out voluntarily. These tenants should not have any eviction history on record.

2) They were required to move out by their landlord (often referred to as “eviction”) for non-payment or other reasons and did so as requested by the landlord. This type of “eviction” will not show up on an eviction report because it is a voluntary eviction.

3) They were asked to move out by their landlord but refused, so the landlord filed for a court-ordered eviction and forced removal of the tenant from the property. This is considered an official eviction and will show up on an eviction report.

An eviction report shows the history of the most costly and time-consuming type of eviction, which is why this report is so vital for tenant screening. A court-ordered eviction can take at best many weeks, and at worst many months. All this time you cannot move in a new tenant and are not collecting rent on the previous tenant, amounting to a huge financial loss.

Personal, Professional, and Landlord References for Tenant Screening

The final critical step in screening a tenant is to verify the information they have submitted on their rental application and interview the prospective tenant. A lot of the information provided on the rental application can be corroborated via the reports above. Additionally, you will want to call employers, past landlords, and other references as part of your tenant screening process.

If the information on the application does not add up or there is any evidence that the tenant provided invalid information on your application, that is an instant sign of trouble and an instant reason to decline the application.

Meeting and performing background screening on all adults that will reside in the household is an important step of rental management. It is normal and allowed in most states to charge a reasonable application fee which will cover your costs to run the combination of all reports above.

Other Types of Reports for Tenant Screening

While credit, criminal, and eviction reports are the most common, and most important, types of reports to review for tenant screening, there are other tenant screening reports available to landlords.

These types of reports include:

- Prior Address Search shows the complete address history of the tenant.

- SSN Verification to verify the validity of the SSN provided.

- Income Verification report provides you a quick and easy way to prove your applicant’s net income.

- Validated Nationwide Sex Offender Registry

- Nationwide Inmate Search

- Bankruptcy, Judgments, Liens Search

- Terrorist Links Search

- State and county level criminal background report.

Where to Find Tenant Screening Reports

Landlords and property managers can order tenant screening report packages on their rental applicants online. Services like Rentec Protect, allow you to order a complete tenant screening package with a credit report, criminal background, and an eviction report for as little as $15/month.

Other services will offer individual reports or report packages at different price points. Some tenant screening services will require a rental applicant to order a credit report on themselves and grant you access to view the report, while other services will allow the landlord to order and review the tenant screening reports themselves.

In order to review a credit report on a rental applicant you must obtain permission prior to ordering the report. There are lots of laws about using consumer reports or tenant screening, so make sure you are ordering, accessing, reviewing, and storing them legally.

Final Thoughts

Regardless of the reports ordered, be sure to comply with all federal and state laws on tenant screening as well as FCRA (Fair Credit Reporting Act) guidelines.

If in doubt, check with your local landlord association which should be happy to help instruct you on the legal aspect of screening prospective tenants.

You might also consider seeking legal counsel to ensure that your rental application and tenant screening process adheres to federal, local, and state housing laws.

This article was originally published in February 2020 and has since been updated.