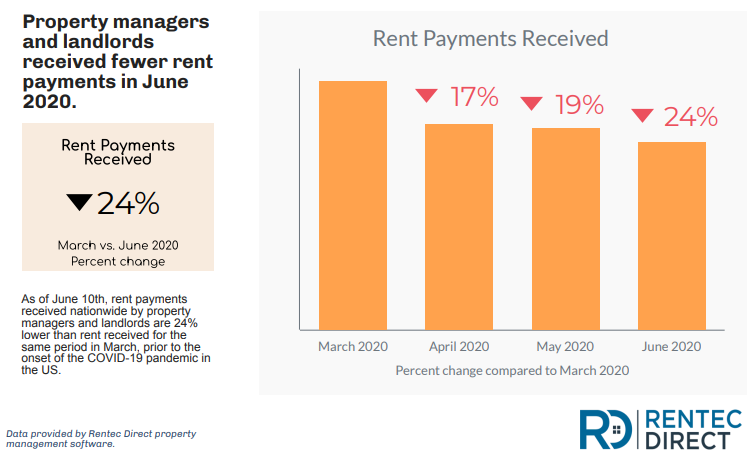

Rent payments received by landlords and property managers are at their lowest point since the onset of the COVID-19 pandemic in the United States, according to nationwide rent payment data from Rentec Direct.

In order to understand how COVID-19 has impacted rental payment habits, Rentec Direct looked at data from over 600,000 rental units in the U.S. by comparing the first week of each month to the same period in March 2020, when most state shutdown orders occurred.

Because most tenants pay rent during the first week of the month, we determined this would give us definitive data surrounding rental payment behaviors. We can also look at data from the first couple of months of 2020 as a baseline for rental payment behavior prior to the COVID-19 pandemic.

2020 Rental Trends Report | Impact of COVID-19 on Rent Payments

- June 2020 Rent Payment Trends Report

- May 2020 Rent Payment Trends Report

- April 2020 Rent Payment Trends Report

Rent Payment Data Key Takeaways

- Rent received has been steadily decreasing since the onset of the pandemic.

- There has been no significant change to the amount of rent received from renters who pay rent online, via direct bank transfer or by credit or debit card.

- Property managers and landlords are adopting online tools to assist tenants, like online rent payment options.

Impact of COVID-19 on Rent Payments for 2020

Over the course of the last three months, we have been looking at the impact of COVID-19 on renters’ ability to pay their rent. With so many Americans losing their main source of income due to national, state, and local stay-at-home orders, it’s understandable that some people are unable to afford some cost-of-living expenses.

Rent is often the most expensive cost-of-living expense, with the majority of Americans spending more than 30% of their income on housing.

The amount of rent received has been steadily declining over the past three months, with data from June 2020 indicating that renters are more financially burdened now than at the onset of the pandemic.

This data is in line with other statistics that show unemployment rates have been rapidly increasing as a result of the pandemic. We can also take note of the fact that only 1 in 4 Americans have more that 3 months of savings, so if unemployment continues to rise, we can expect to see a continued decrease in the amount of rent received in the coming months.

Even with the $1,200 stimulus check sent to qualifying American households, a majority of recipients used their stimulus check to catch up on bills and rent, according to MarketWatch. Since the stimulus check was used for past bills and rent, it would not have been able to cover June rent payments. Recent data from the IRS indicates that as many as 35 million Americans are still waiting to receive their stimulus checks.

National Unemployment Rates

Reflecting the effects of the coronavirus pandemic and efforts to contain it, the unemployment rate and the number of unemployed persons are up by 9.8 percentage points and 15.2 million, respectively, since February 2020, according to U.S. Bureau of Labor Statistics.

American Financial Savings Data

Nearly three in 10 (28 percent) U.S. adults have no emergency savings, according to Bankrate’s latest Financial Security Index. One in four have a rainy day fund, but not enough money to cover three months’ worth of living expenses.

Online Payments Increase the Likelihood of Paying Rent

Despite overall rent payments received decreasing by 24% in June 2020, online rent payment data show only a 1.4% decrease in online rent payments received. This indicates that renters who have the option to pay rent online, either by a direct bank transfer or by credit or debit card, are more likely to pay rent.

The Future of the Rental Housing Industry

COVID-19 has forced every industry to adapt. During the global shut down, the rental industry discovered new ways to meet social distancing requirements and adhere to stay-at-home orders, while providing essential housing to renters everywhere.

As we enter a new phase and the country slowly begins to reopen, we will continue to see the use of digital experiences for property management. Almost all rental management tasks can be completed online with property management software tools and apps designed for the rental industry.

Property managers and landlords can use tools like:

- Online rent payment options

- Virtual inspection tools

- Online rental applications

- Electronic signatures for signing lease agreements remotely

- Online rental ads and virtual showings

- Online maintenance requests

- Tenant Portal for instant resident communication

Online tools, like these, are necessary options for property managers and landlords who need to conduct the majority of their business remotely. One of the challenges with working remotely, however, is remembering to stay connected with your residents and facilitate a positive landlord-tenant relationship. Rental professionals can look to these tips for staying connected with tenants and property management teams while social distancing.