This year you can file your 1099-MISC forms for owners and vendors electronically through Rentec Direct. There’s no need to re-enter data or pay your tax advisor to file these forms on your behalf because it’s very simple and extremely cost-effective to file them electronically through Rentec Direct. Rentec provides full e-file functionality with the IRS as well as mail out, as necessary, paper copies to the recipients and states. In preparation, we recommend the following:

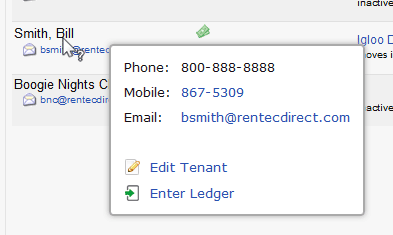

- Edit your vendors and owners and verify you have the correct federal tax id number. For individuals, this is their social security number (SSN), and for businesses, it’s their employer identification number (EIN). Request a W-9 form from any vendor or owner for whom you don’t already have one on file.

- While in there, verify that the mailing address is accurate for each owner and vendor. The address is where their copy of the 1099 form will go to, which they will use for filing their personal or corporate return.

- Verify your numbers. It’s never too early to begin auditing your data. Review the 1099 Tax Assistant report and make sure the number matches your records. This same data will be used for populating the e-file in January. This report and the 1099 e-file system will utilize all the owner distributions and vendor payments entered throughout the year, so there’s no need for double-entry.

When you are ready to file (or test), go to Settings, Utilities, 1099 E-File, and Print.

1099-MISC Electronic Filing Pricing Follows (this is handled through an IRS Approved 3rd Party who will bill separately for the service)