Online rental applications are becoming commonplace these days, and often well-received by landlords and property managers who benefit from the efficiency of automating the leasing process.

One of the drawbacks of online rental applications, however, is the possibility of a tenant or rental applicant issuing a chargeback for the application fee.

What is a Chargeback?

Under the Fair Credit Billing Act (FCBA), consumers have the right to dispute charges they believe have been made in error on their credit card, this dispute is known as a chargeback.

According to Credit Karma, “A chargeback is a dispute of a purchase that has already been charged to an account that can result in a return of funds.”

Chargeback for Rental Application Fee

For landlords and property managers, a rental application chargeback happens when an applicant pretends he never authorized payment for an online rental application, disputes it with his credit card company, the credit card company complies and cancels the payment to you. The landlord or property manager ends up with a canceled payment and sometimes additional fees from his bank or merchant.

This is the same headache you may deal with when an applicant’s check bounces and unfortunately, just how works in the credit card world. Fortunately, the chances of it happening are extremely low.

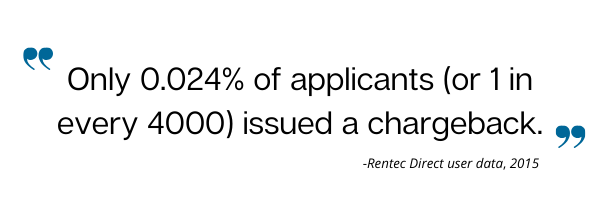

According to real user data from 2015, Rentec Direct landlords accepted over 50,000 online applications and less than a dozen of those have resulted in a chargeback. That’s only 0.024% of applicants (or 1 in every 4000) that issued a chargeback.

Despite it being a low percentage, there is the occasional confused or disgruntled applicant who is upset about being rejected. They might feel the best way to get back at you for rejecting their application is to issue a chargeback. I just assisted one of our clients with this today, and it can feel frustrating because as we all know (or maybe not), the banks will always initially side with the cardholder, never the merchant.

Here’s how a typical application fee chargeback happens.

- The applicant applies for your property online and pays the application fee (typically $20 – $50 per person).

- During your review process, you probably order credit and criminal tenant screening reports on the applicant.

- During your review of the applicant’s data, they do not meet your requirements, and you reject their rental application.

- Sometime within the next 60 days, the applicant gets their credit card statement and they feel they might be able to “stick it” to the property manager by charging back the fee. After-all, they might have done this before with other merchants when they felt they didn’t get the product or service they wanted. In this case, what they wanted was to rent from you, and they didn’t get what they wanted.

- Also note, some chargebacks are accidental. Read more about this below.

- The cardholder’s bank will immediately pull the funds out of your account and give them back to the cardholder (the applicant). The cardholder also issues a “chargeback fee” for handling the request to the merchant. Unfortunately, even though you are right and the cardholder is wrong, this is just the way accepting credit cards works and this is how it works with all merchants. [This is just like a bounced check fee that your bank imposes if you deposit a NSF check.]

- If you have your own merchant account, your merchant provider will notify you that the cardholder issued a chargeback. If you use Rentec’s EasyPay service without a merchant account, we will get notified and pass along the message to you.

How to handle rental application chargebacks.

The credit card companies allow the cardholder’s bank (the issuing bank) significant flexibility and authority in determining whether a transaction is valid. Because the cardholder is the bank’s customer, it’s not uncommon to see the cardholder’s bank side with their customer rather than the merchant in many cases. This is especially common in “card not present” or “signature not present” situations, which is the case for all e-commerce and electronic rental applications.

The good news is that you are legally owed the money and the law is on your side, even if the credit card companies are not. Here are some options:

Option 1 – Challenge the dispute.

If you have your own merchant account, you are given the option by your merchant provider to dispute the cardholder’s claim. You can provide evidence that the transaction is legitimate and the cardholder owes it to you. It is up to the issuing bank (the cardholder’s bank) to determine if you supplied enough evidence to warrant a reversal of those funds back to you. You’ve already paid a “chargeback fee”, and your merchant provider may charge you a 2nd fee to initiate the dispute so be sure to consult your merchant provider first.

If you dispute the claim, here is what we recommend you supply:

- A copy of the final payment page of your application process which will show the application fee and the language stating that the fee is “non-refundable”. You can get this by applying for one of your own properties, and make a screenshot or print-out of the payments page (without credit card information in it). You don’t have to submit the application.

- Open up the chargeback applicant’s application in your property management software, and choose “printable version”. Mark out the SSN to make all but the last 4 of the SSN illegible.

- A written explanation that explains that this applicant came to your website, and submitted the following information. State in bold that the tenant electronically agreed that the fee is non-refundable. Also state that, pursuant to the Electronic Signatures in Global and National Commerce Act as well as the “Uniform Electronic Transactions Act” (UETA), the cardholder is legally bound to the terms that they agreed to when submitting the application and the funds are rightfully and legally due to you, the merchant.

By supplying this information, you have the best chances of having the application fee returned to you.

If you do not have a merchant account, the dispute option is not available. Getting setup for a landlord merchant account is very easy though, CLICK HERE to learn more.

Option 2 – Collect directly from the applicant.

As you saw, option 1 is pretty involved, might have fees, and may return you nothing. After-all, it is the cardholder’s bank that makes the decision and if they feel it’s at all within their grey area they are going to side with their customer (the cardholder). As such, we’ve seen the best results when property managers collect the application fee directly.

As I mentioned earlier, most applicants are just trying to get the last word and stick it to the landlord that didn’t rent to them. They don’t understand they are committing fraud by doing this. A quick phone call or letter to the applicant can often quickly resolve the issue. They should be reimbursing you for both the application fee and any chargeback fee you incurred from your merchant processor. Here’s a phone script that I’ve gotten from property managers who have said it is quite successful:

“Hi Joe. You applied to 123 Marshmallow St on July 31st and used a credit card to pay the $30 application fee. I was just notified by the bank that the card holder issued a chargeback of this fee. When you filled out the application online it was stated clearly that the fee was non-refundable and that applied whether you were approved for the property or not. We would like to make arrangements with you to stop by the office and reimburse us for the application fee that you charged back along with the fee we incurred from the bank.”

If their response is not amicable to resolving the issue, continue with:

“If you are unable to make good on the application fee, I am instructed to turn this over to our collection agency. They will report this to public records including the credit bureaus and attach all their legal fees for doing so to the judgment. If you want to avoid that, please come into the office this afternoon and take care of the balance. If we don’t see you before the end of the day tomorrow we will be turning this over to the collection agency in which case all future dealings will be with the collection company.”

If they do not respond and you want to push forward with collections, we’ve found a very economical and easy way to do this. Rent Recovery Service takes care of sending the legally required collection letters and reporting to the credit bureaus for a very reasonable fee ($26.95 at the time of this article). CLICK HERE to visit their website and setup an account. Having a ding on their credit report is a very compelling way to get a debt collected quickly.

Option 3 – Just let it go and count your lucky stars you didn’t rent to this applicant.

Consider what your time is worth. Option 1 is going to take you 30-60 minutes to complete. Option 2, if they don’t pay up immediately and you have to turn it into collections is also going to take at least 60 minutes to setup an account and report the debt. If your application fee is the industry average of $35, then it’s really not worth more than 30 minutes of your time considering the opportunity cost (what else you could be doing to better your business) and what most property managers value their time at. It may just be better to let this one go, and focus on something that grows your business or position at your company rather than dwelling on a few lost dollars from a disgruntled applicant.

Plus consider this – You just dodged a bullet! Thank goodness you didn’t rent to this applicant who so easily defrauded you of a small charge. Imagine if they wanted to dispute a full rent payment, or months of rent payments, or their security deposit. The loss of the application fee is nothing compared to what you might have suffered had you rented to this applicant.

Accidental Chargebacks Can Happen Too

Sometimes the applicant is reviewing their card statement and they legitimately don’t recognize the charge. As an example, they might have forgotten your company name since the time they applied.

Another common example is when the applicant does not posses a credit card and they use a friend, roommate, or family member’s card. The cardholder then is much more likely to not recognize the transaction when reviewing their statement. They may have forgotten that they loaned out their credit card. The cardholder agreed by proxy to allow their card to be used, so they are still responsible for the charge, but it’s a much more forgivable situation.

In instances like either of these, a call to the applicant using the phone number they provided on their application is in order. Most applicants will clear it up right away by coming in and paying you the fee in person.

How To Prevent Chargebacks From Happening

The easiest way to prevent chargebacks from happening to you is to be up-front about the application fee and ensure the applicant understands that it is non-refundable. Some applicants might be confused and think the fee only applies if they are approved.

Make sure the wording on your application is clear and if you discuss the fee with the tenant in person be clear that the fee is for the application and is non-refundable. You can also make it clear that any chargebacks will be dealt with aggressively and even state on your application that all collection efforts will be the responsibility of the applicant if the payment is charged back or returned for any reason. In Rentec Direct you can do this by editing your application defaults, and setting custom text in the instructions text box.

As a renter, and being rejected on my 8th application, I can see why people are inclined to charge back. I’ve spent over $300 on applications and screenings. Perfect background, excellent credit, and long term reliable work history that far exceeds rental costs… sometimes we feel like landlords are being fraudulent with our fees and taking advantage. Personally, I’m sick of literally throwing my money away, especially when finding a place is so much work on my part.

Hi Mike! You may want to research your local/State housing regulations on acceptable rental application processing and fees to see if the landlord is in compliance. There also may be other reasons for the denial of an applicant to consider. Lastly, ask the minimum income, debt-to-income ratio, and credit score criteria before applying. If denied based on a credit or background check report, ask the landlord to provide a denial letter (also known as an Adverse Notice) which will allow you the opportunity to request a copy from the database partner for review, repair, and/or dispute of any item(s). With that, I wish you all the best success in your house hunting endeavors!

yeah its laughable. just paid 60$ app fee and found out i was rejected before they even contact me two past landlords or references. above 800 credit score and no justification why i wasnt selected. id have no problem if there was more transparancy but im absolutely going to dispute the charge with my credit card company because i have zero faith that between the time i submitted the app at 10:30 pm and 10:30am the following day, any orderly equal/fair process was done to widdle me out compared to whoeevr they selected.

**** the property manager as far as i am concerned that is a SCAM

It is within your right to receive a denial letter from the landlord or property management company and this article will give you more context and information on that subject that I hope you find helpful: Legal Requirements for Denying a Rental Applicant (Adverse Acton Notice)

I currently fighting an eviction initiated by my landlord due to a chargeback…THAT I NEVER INITIATED NOR HAVE ANY KNOWLEDGE OF! Since i moved in, all payments to my landlord have been via check or money order, including my security deposit and application fees. in March my landlord gave me information to contact my bank regarding a chargeback that I supposedly initiated. I was confused and curious, so I contacted the credit card company only to find out that they could not give me any information because my name does not match the account holder. I contacted the landlord and informed them and reminded them that I had paid via check every time. But found that the manager was on maternity leave. I explained everything to the interim manager and pointed out that I had paid my full deposit via check. If this chargeback were mine and I paid the fees they sought, I would actually be paying an additional deposit which is not stipulated in my lease agreement. Agreeing with me, the interim manager apologized for bothering me and forcing me to pay the fee (I paid it under duress and to stop the harrassment until the situation could be resolved) and then stated that the fees I paid would be credited to my account to cover my utilities so I wouldnt need to pay for the next few months. The manager returned from maternity leave and re-posted the chargeback to my account. Then in May she refused to accept my rent payment without paying the chargeback fees…now being called utilites since she applied the payment I made to the chargeback. In eviction court, the judge did not allow me to present or mention the chargeback and granted my landlord a judgement. I am now appealing that decision. All of this over a chargeback that isnt even in my name. I have never paid late or caused any issues, but now being evicted for something I never did. As a widowed mother with 3 children and no family support, my children are devastated as I promised that we wouldnt move again until they complete high school, but sadly it’s only been six months. Really unfair. I even obtained certified checks for the two months rent that would have been paid during this process and had them in court to show good faith and intention of paying, but my landlord’s attorney didn’t care. Truly unbelieveable…

That’s a really rough story Ketra, sorry to hear about all the trouble. I think it is pin-pointing the frustration that all merchant have with chargebacks though. The banks have encouraged consumers to “just issue a chargeback” so frequently that it’s become a huge nuisance for all merchants, not just property managers. The banks charge merchants upwards of $25-35 for the chargeback, so they are making money by recommending their own customers often commit fraud by charging back legitimate stuff. The banks don’t care because they are not at risk, they make money either way whether it be by the 2-3% they charge the merchant, or the $25 they get in chargeback fees – or both in many cases. The credit industry really should require consumers contact the merchant before issuing a chargeback so the problems with chargebacks in general can go away and merchants can lose the hard-line stance when they do occur. Sorry, even if the banks to straighten up and address chargebacks it won’t solve your problem, but it might help others in your position in the future. I hope your housing situation gets figured out soon.